The Coinbase Q4 earnings story exploded on social media this week, but for all the wrong reasons. A viral post warned that Coinbase users were locked out of trading just as the company revealed a staggering $667 million net loss and an 8% stock plunge.

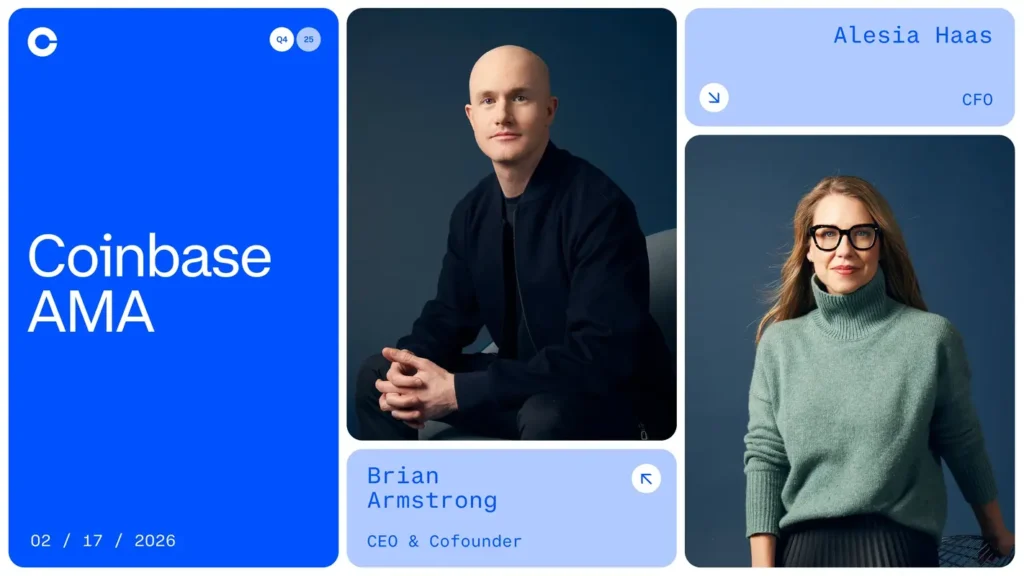

To make matters worse, rumors swirled that CEO Brian Armstrong cashed out $550M as the chaos unfolded. But what is fact versus FUD?

As someone who has traded through three major Coinbase downtimes while building Python trading bots, I can confirm: these glitches expose exactly why “not your keys, not your money” matters. This deep dive looks into the official filings, outage logs, and the critical self-custody lessons for 2026 traders.

What Triggered the Q4 Financial Firestorm?

Coinbase released its Q4 2025 results on February 12, 2026, posting a $667 million net loss, a sharp flip from the profits seen in Q4 2024. Revenue missed estimates significantly, landing at $1.78B (-21.5% YoY), hammered by 37% lower trading volume as Bitcoin slipped below $90K.

The drama started even before the numbers dropped. At 10:07 AM PST, hours before the earnings report, the nightmare hit: users couldn’t buy, sell, or withdraw crypto for approximately 80 minutes. Status.coinbase.com logged “website errors disrupting trading,” while Reddit and X lit up with frustration: “Perfect timing during the dump.”

Q4 2025 vs Prior Performance:

| Metric | Q4 2025 | Q4 2024 | % Change |

|---|---|---|---|

| Net Loss/Profit | -$667M | +$1.3B | -151% |

| Revenue | $1.78B | $2.27B (est.) | -21.5% |

| Trading Revenue | -37% | Peak | Sharp drop |

| After-Hours Stock | -8% | N/A | Investor panic |

You may also like: OpenClaw Security Risks: Hype vs Reality Guide (2026)

How the Chaos Unfolded

- 10:07 AM PST: Trading and transfers freeze per user reports.

- 11:26 AM PST: Services restore; Coinbase confirms the issue is “resolved.”

- 4:05 PM PST (After Close): Coinbase reveals $667M loss; shares tank 8% in after-hours trading.

Brian Armstrong’s $550M Sales: Suspicious Timing?

Social media claims ignited suggesting Armstrong sold his shares during the outage.

The Reality: He offloaded 1.5M shares (~$550M) between April 2025 and January 2026 via legal 10b5-1 trading plans. His latest sale was actually 40,000 shares on January 5 (valued at $10M at $255/share).

While there were no outage-timed dumps, the optics still sting. With COIN stock down and his net worth cut by $10B, the sentiment remains sour. As noted in a recent market analysis by KuCoin, “Pre-arranged sales protect execs, not users.”

Are CEXs Just TradFi Banks Waiting to Fail?

Viral posts are drawing parallels between this outage and major financial collapses.

- FTX (2022): $32B fraud hole.

- SVB (2023): $42B liquidity run.

- Lehman (2008): Confidence collapse.

Coinbase vs. TradFi: A Risk Comparison

| Platform | Core Risk | Coinbase Status |

|---|---|---|

| FTX | Fund misuse | Segregated (regulated) |

| SVB | Bond losses | $200B+ AUM insured |

| Lehman | Leverage | U.S. compliant |

Tip: Funds appear safe, but the combination of mass withdrawals and outages creates “bank-run” vibes that traders should not ignore.

What Crypto Traders Must Do Now

The events of February 12–14 prove that even regulated platforms fail when stressed.

- FTX (2022): $32B fraud hole.

- SVB (2023): $42B liquidity run.

- Coinbase (2026): 80-minute freeze during volatility.

Immediate Action Plan

- Check Balances: Ensure your app shows intact holdings.

- Secure Accounts: Enable 2FA and vault timers immediately.

- Withdraw to Self-Custody:

- Hardware: Buy a Ledger Nano X ($149).

- Transfer: Go to App > Send > Paste wallet address.

- Trade on DEXs: Use Uniswap for altcoins; limit your CEX exposure to a “1-week hot wallet” (only keep what you trade weekly).

- Tax Prep: For Pakistani traders, track FBR capital gains via Koinly.

Social Media Reacts to the Chaos

- BSCNews (X): “Users frozen during earnings chaos, move to self-custody.”

- r/CryptoCurrency: “CeFi = banks with better PR.”

- Influencer Post: “CEO cashed out while you couldn’t.”

Coinbase outage Q4 earnings proves platforms fail when stressed. I’ve pulled funds post-outage (1hr delay) works, but plan ahead.

Conclusion

The Coinbase Q4 earnings saga underscores a timeless crypto truth: centralized platforms promise convenience but carry custodial risks that surface exactly when you need them most.

Centralized exchanges remain vital for on-ramps and fast trades, yet the optics of a $667M loss combined with a trading freeze remind us that preparation beats panic. Move 80% of your holdings to hardware wallets like Ledger, limit hot balances, and embrace “not your keys, not your money” as a strategy, not just a slogan.

Action steps for HashTechWave readers: The crypto market rewards the vigilant. Stay ahead of outages, track Q1 earnings (April 2026), and subscribe to HashTechWave for real-time analysis.

FAQs

What caused the Coinbase Q4 earnings chaos?

Official reports from Coinbase spokespeople indicated the outage was a technical issue unrelated to trading volume, resolved in roughly 80 minutes.

Are user funds safe after the recent technical failure?

Yes, funds are segregated and insured. However, it is best practice to avoid keeping large balances on exchanges.

Did Brian Armstrong sell stock during the trading freeze?

No. His sales were pre-planned over the last 9 months via 10b5-1 plans, not a reaction to the outage.

What are the best wallets after the Coinbase outage?

Ledger Nano X and Trezor are the industry standards. We recommend moving 80% of your long-term holdings to cold storage.